Myths Versus Facts – Is China’s Belt and Road Initiative really a “predatory debt trap”?

Many international criticisms have accused the Belt and Road Initiative of being a “predatory debt trap” favouring China’s own interests.

China’s Belt and Road Initiative (BRI) was first put forward by Chinese President, Xi Jinping in 2013 and it is by far the most ambitious foreign policy and infrastructure effort in history. The goal of the BRI is to improve trade and build a vast network between 65 countries from Southeast Asia to Eastern Europe and Africa, while helping these nations who are in need of infrastructure funds.

Despite being widely recognized as an infrastructure development project, which will enhance the trading routes and investments between China and the participating countries, the BRI has come in for criticism by some. Many believe that the help and money that China is giving will come with its own set of conditions, such as high-interest payments which will cause debts as China is offering huge loans to countries that are already burdened by debt.

However, China stresses that this initiative is a “brand of cooperation” characterized by inclusiveness and openness while putting the best interest of the participants forward.

China’s efforts against debt

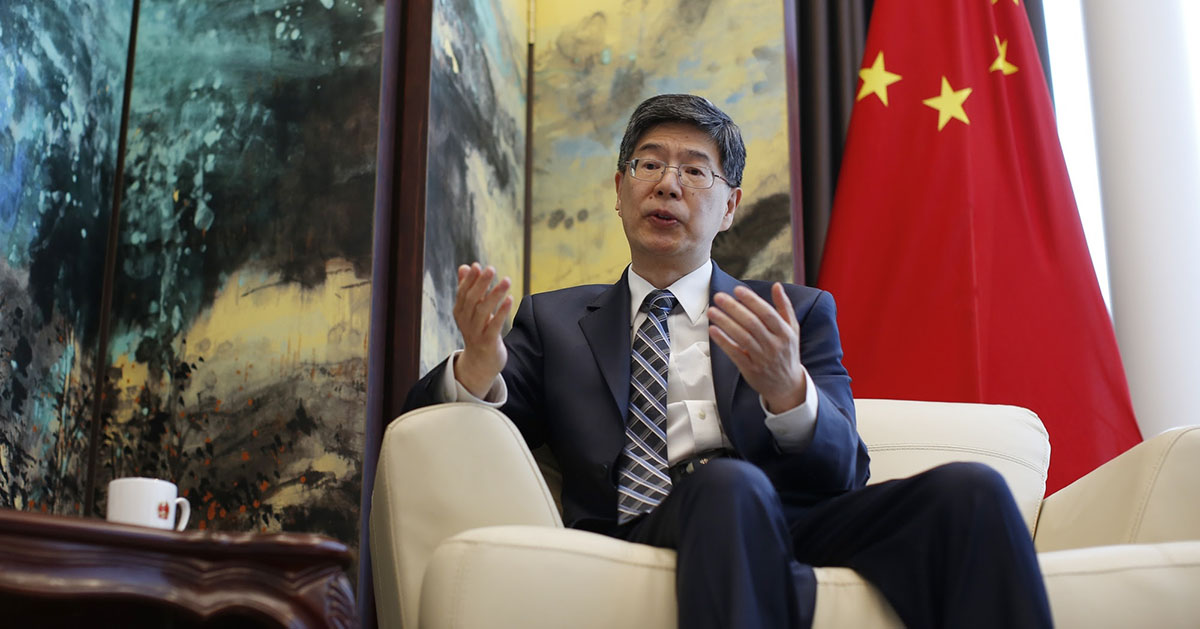

In March 2019, Beijing hosted the Second Session of the 13th National People’s Congress during which National People’s Congress spokesman and former foreign affairs vice-minister Zhang Yesui contested the criticism that the project creates debt traps for participants, especially for developing countries.

“China attaches great importance to the problem of debt sustainability and will neither force others to cooperate on projects nor create any traps,” Zhang said.

A study conducted by the Rhodium Group, a New York consultancy has found that China is prone to renegotiate or even write off debts because of BRI projects and only in rare cases will they seize assets.

The researchers studied 40 cases of debt renegotiation that occurred between 2007 and 2019 and discovered there was only one case where assets were seized in Sri Lanka in 2016.

This study challenged the claims that the BRI participants will be left with debts they cannot repay and will then be forced to hand over their assets or natural resources to China. But also showed that China had renegotiated around US$50 billion of loans and in most cases, the participants’ debts had either been written off or payment was postponed.

One example presented in the report was Cuba, which had US$2.8 billion in debts written off in 2010, while Ethiopia had announced that China chooses to forgive interest due on BRI loans. According to the report, debt forgiveness was motivated by China’s desire to improve relations or relieve critical financial distress.

A Debt Sustainability Framework

During the Second Belt and Road Forum in Beijing in April 2019, Finance Minister Liu Kun presented a debt sustainability framework for participating nations, which was published to refute the concerns about the financial drawbacks of the BRI. According to Minister Kun, this 15-page document was created by applying similar standards used by the World Bank and the International Monetary Fund.

He further explained that the aim of this report was to “prevent and solve debt problems” that could emerge from projects built under BRI. While it will encourage Chinese financial institutions and participating countries to improve the management of their debt. Through this framework, China tried to address accusations about countries being drawn into debt and how they will need to use Chinese labour, products and technology and will have to grant long-term access to their natural resources.

This framework will also be used to evaluate the debt risks countries involved in the BRI might face by organizing their potential liability as “low, medium or high”. Yet Minister Kun emphasized that “it should be noted that even if a country is assessed as being ‘high risk’ or even ‘in debt distress’, it does not automatically mean that its debt is unsustainable in the long term”.

Xiao Yaqing, the head of China’s state-owned assets watchdog, further addressed these concerns by reassuring that although projects under the BRI are conducted by Chinese firms and money, they are also creating huge job opportunities in each participating nation. As more than 85 per cent of the people employed in Chinese state-owned enterprises overseas were locals.

In Pakistan, for example, the BRI project that helped build a motorway between Karachi and Peshawar helped train 2,300 local management and technical workers and had already created over 23,000 jobs, said Yaqing.

The Philippines dismissing the fear

Philippine Finance Secretary Carlos Dominguez as dismissed the fear that the Philippines are drowning in debt because of China during a speech in March 2019 by saying that the Philippines’ debt to China represents 1 per cent of its total debt. And “at the end of 2022, the Philippines’ debt to China will be 4.5 per cent of our total debt. The debt to Japan will be 9.5 per cent. Now I don’t know why people are not saying we are going to drown in Japanese debt,” Dominguez said.

He added that "the important thing about debt is to make sure that they are invested in projects that whose economic return is higher than the cost of the debt and so far this is what we have done”, showing that the BRI is not worsening the country’s debt problems.