Thank the bank but hold the standing ovation

by Greg MacDougall and Steve Saunders

As Ottawa’s winter slowly transitions to spring, and a young Senators team tantalizes fans with glimpses of a promising future, hockey fans debate the relative merits of Connor McDavid, Auston Matthews and Patrick Kane as winner of the Hart Memorial trophy, emblematic of the NHL MVP. There is no such debate in the Canadian banking world, nor should there be in the world of Canadian government.

If there were a Hart Memorial trophy for governance, it should be presented now, in the middle of the Covid-season to Richard Tiffany (Tiff) Macklem, Governor of the Bank of Canada. In fact, the new Bank Governor – appointed in June 2020 – deserves another trifecta of awards; New CEO of the Year, Strategist of the Year, and Innovator of the Year. He is the most important person in the Government of Canada, and in these pandemic days, that makes him the most consequential person in Canada. Yet, many will not recognize his name, and a small few would be able to pick him out of a line-up.

Cast your mind back to August 16, 2020 to then-Finance Minister Bill Morneau’s resignation in the midst of ethics investigations related to the WE charity scandal. Mr. Morneau was rapidly replaced by Deputy Prime Minister Chrystia Freeland, and voila, before the nameplates had been changed at the Flaherty Building, it was like he was never there. The departure of Finance Deputy Minister Paul Rochon in December 2020 was arguably more serious; Mr. Rochon had a stellar reputation for vision and competence, and a portfolio knowledge unmatched in the current DM cadre. Still, his departure four months later left barely a ripple. Abrupt senior changes at the Department of Finance used to move markets. Today, an arched eyebrow and a shrug.

In the past, Canadians didn’t need to know who was the Governor was, and aside from periods of intense inflation fighting in the 1980s and early ‘90s, Canadians didn’t care. The grey world of central banking was populated by even greyer personalities. The pandemic has changed all that. Macklem, now more than Freeland occupies the nexus between fiscal and monetary policy. In pursuing aggressive quantitative easing (QE), the Bank’s monetary policy both leads and enables the government’s fiscal policy priorities.

Under Macklem’s leadership, the Bank has moved beyond its core mandate of ensuring price stability – wielding monetary policy to generate sustainable inflation – to address employment concerns and green growth goals. If you were seeking a comprehensive comparative analysis of provincial responses to Covid infection and hospitalization rates, and effectiveness of containment measures, you might look to Health Canada or the Public Health Agency of Canada. Well, you won’t find it in those places. You won’t find it at Finance Canada either. You will however, find this granular data on the ‘stringency index’ at the Bank of Canada.

Political power and influence in Ottawa is a zero-sum game, and Macklem has proven himself a deft player. Freeland has been left sitting at the end of the bench. Unconvinced? Compare the number of detailed speeches that provide insight and guidance by both since August; Macklem leads 6-2. Detailed media availabilities; discounting QP appearances which in our diminished Parliament do not count, Macklem again has excelled. Who recently picked a fight with Statistics Canada over inflation definitions, and won? In a normal world, Finance would wield the stick. Not these days.

With its purchases of commercial bank debt, provincial bonds and Government of Canada debt, the Bank is the singular bulwark behind the Trudeau government’s crisis response. And as a result of its QE process, and historically low interest rates, exacerbated by inventory shortages, the Bank has created the conditions that have seen housing prices in large and small centres across the country go through the roof. Receive the CERB? Thank the Bank. Live in a province on the verge of bankruptcy that needs saving – here’s looking at you Newfoundland and Labrador? Thank the Bank. Just locked in a five-year mortgage under 1.8%? Again, thank the Bank.

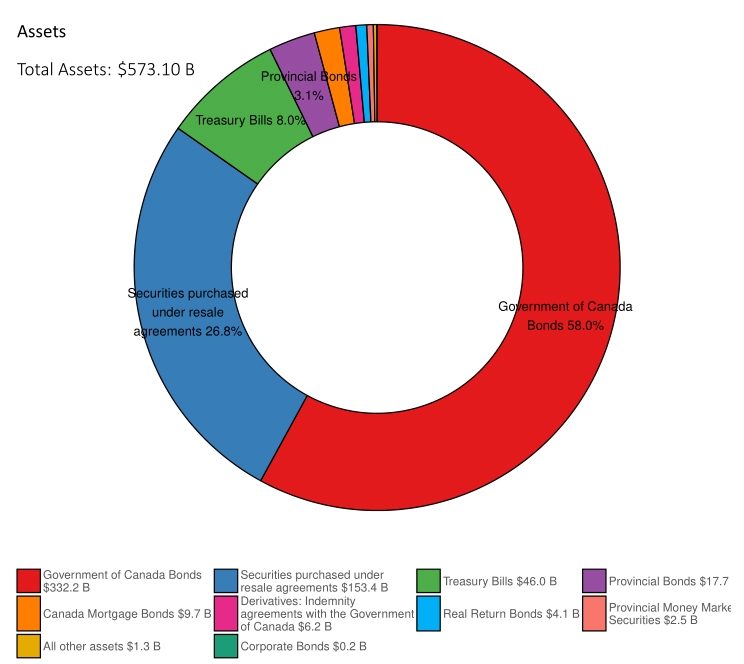

On March 2, 2020, the Bank held less than $2 billion in mortgage bonds. A month later, that number had doubled, and peaked in November at nearly $10 billion. Nothing nefarious here. The Bank had simply bought underperforming mortgage debt (and other commercial paper) from Canada’s lenders, and issued these institutions fresh capital in the form of Banker’s Acceptances.

This cash infusion ensured the commercial banks had the reserves for mortgages, personal and business loans, thus ensuring liquidity in the banking system during the pandemic’s chaotic early shutdown days. Banker’s Acceptances are defined as a “negotiable financial instrument used to raise short term funds in the money market”. Indeed, Bank holdings of these instruments peaked at $38 billion three weeks after the March shutdowns began, and fell dramatically to zero by July. The system worked, and for this former Bank Governor Stephen Poloz deserves much credit. In a similar fashion, the Bank has quietly purchased more than $15 billion in provincial bonds, allowing provinces to bypass more expensive (i.e. the need to pay higher interest rates) private markets. The Bank does not disclose which bonds it has purchased but one can surmise that Newfoundland and Labrador was at the front of the line.

But it’s in financing the Trudeau government’s current year $381 billion (and climbing) deficit, where Tiff Macklem has most demonstrated his political acumen; unilaterally pushing aside the Minster of Finance and all those people who work for her. When the crisis struck last March, the Bank held $100 billion in Government of Canada Bonds and Treasury Bills. As Canadians celebrated New Year’s Eve hunkered down, these holdings surpassed $475 billion. Overall, the Bank’s balance sheet has soared to nearly $600 billion.

The Bank has done this through the QE process whereby the Bank has committed to buying federal bonds at a rate of $4 billion a week. The Governor stated earlier in February that, “Our focus is on providing the amount of monetary policy stimulus that we need, to support recovery and to get inflation back to target… It’s by purchasing the bonds out the yield curve that we are lowering the costs of borrowing for Canadian households. That is how QE is delivering monetary stimulus.”

The Bank is at one and the same time, delivering on its 2% inflation target by providing stimulus – getting money circulating in the economy, hopefully stirring overall inflation to the target – and handing a fiscal howitzer to Chrystia Freeland to pay for the Covid response. It’s so yesterday to visualize a printing press in the basement of the Bank’s headquarters on Wellington Street throwing off sheets of printed bills. That function is now achieved through a few key strokes on a laptop. But the effect is the same. The Bank’s balance sheet has swollen over the past the past ten months, as the federal deficit, and debt rocket to infinity and beyond.

So what can go wrong? “Events, dear boy, events”, as mid-20th Century British Prime Minister Harold MacMillan retorted when asked a similar question. We’ll examine several points next week. Will Canada emerge from Covid and step into a ‘roaring 20s’ scenario? How does the Bank manage the tapering of the QE process, and will the Trudeau government institute some semblance of rigour to public finances? And what role should Parliament play through this process? Tiff Macklem has been a force offensively in the economy through the pandemic. Canadians will soon see if he can play defence as well.

Greg MacDougall and Steve Saunders are partners in Government Analytics, an Ottawa firm that specializes in mining, analyzing and formatting government data so that it may be easily communicated for advocacy or corporate purposes. GA utilizes proprietary software to transform raw data into visualized, in-depth evidence.